Written by Brent J. Welch, CFP®, ChFC, CRPS®, CLU, AIF®

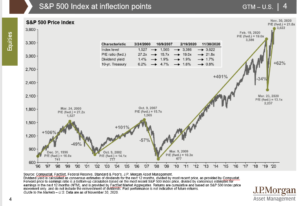

In 2020, we set a new record! We all experienced the shortest “bear market” in history!* A bear market is defined as a market drop of 20% or more. During the horrifical banking crisis of 2009, Warren Buffet was asked on CNBC, “What’s the market going to do?” He calmly replied with his steady, low voice, “The market will go up and the market will go down”. We definitely have seen that in recent years. With a stock market crash, political upheaval, civil unrest and a worldwide pandemic, we experienced a bear market last year.

In 2009, we had a bear market that was sustained through deep-rooted fears. These fears included the collapse of the banking system in America, the collapse of Bear Stearns, the economic future of corporations such as General Motors that were on the brink of disaster. Municipalities, state governments and the federal government were all in jeopardy. Congress could not decide what to do.

In 2011, there was also a banking crisis in Europe, not America. One of the worst pieces of news was that the US government almost defaulted on government bonds. Congress stepped in and corrected the course. By borrowing yet more money, they saved the day.

In 2020, we experienced a global pandemic, a neck-breaking bear market, hostile election year and civil unrest. By creating new government programs designed to get money into the hands of displaced workers and companies affected by the pandemic, the bear market recovered and showed a nice gain through the rest of the year. Once again, we leveraged our future with easy monetary and fiscal policy. Borrowed and printed money is injected by congress into the economy at a record-breaking pace. Did you know that in 2020, the government borrowed $4.3 trillion dollars just to hit our annual budget. Take a look at this screen shot from www.usdebtclock.org. Our overall US National Debt exceeds $27 trillion. Our debt to GDP ratio, (Gross Domestic Product ratio), is 148% compared to 35% back in 1980.

Almost every year in recent history, we borrowed more than $1 trillion. However, in 2020 the government borrowed $4.3 trillion just to operate! This mounting debt is going to be daunting to the economic future of America. This new economy is based on the perceived value of the dollar, otherwise known as Fiat currency. Because there is no gold standard anymore, the standard becomes the gross domestic product or GDP of each nation as interpreted by accountants, balance sheets and income statements. The M2 Money supply 2 is now at an eye-popping $19,197,941,251,374. The US has total debt that now exceeds $86 trillion. This mounting debt will eventually create severe problems for the economy.

Welshire is actively looking for ways to protect your money. Five years ago, I wrote a book that included in it’s pages, “the 8 investment strategies for life”. If you would like a copy of this book, on the Welshire.com website and request a copy on the schedule a review page. Please set up a review ASAP with your Welshire Wealth Advisor to help you work toward retiring with more confidence and peace. They can help guide you through these options and you can decide what is most suitable for you.

As Patrick Kelly said in his book, Stress-Free Retirement, “it wasn’t raining when Noah built the ark.” In other words, the best time for taking action is before the storm hits. Please contact Welshire at your convenience and schedule a conversation with your Welshire Wealth Advisor today. We look forward to our conversation! Call 1-800-TAX-PLAN.

*JPMorgan’s Guide to the Markets, Q4, 2020